self employment tax deferral due date

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for. Heres how to pay the deferred self-employment tax.

How To Defer Social Security Tax Covid 19 Bench Accounting

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020.

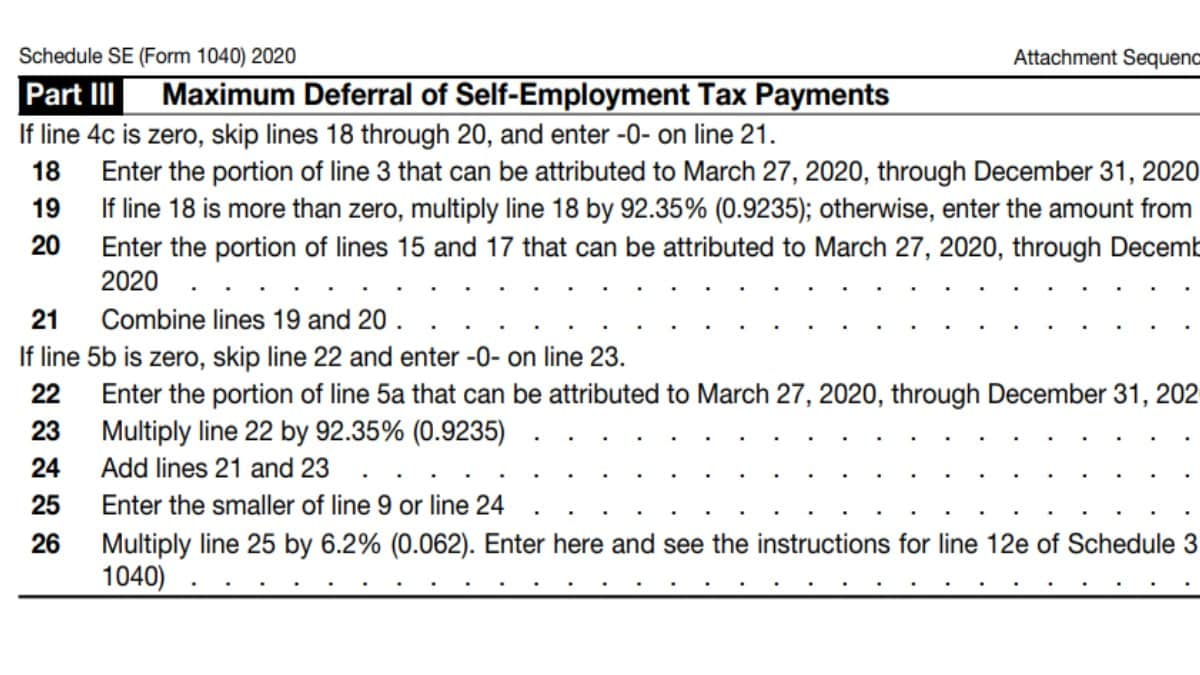

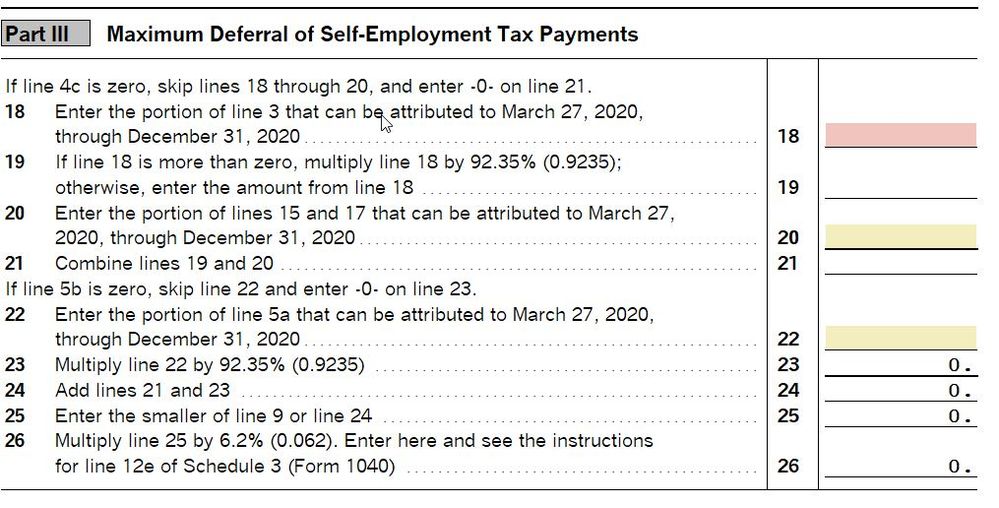

. The CARES Act allowed employers to defer deposit and payment of the employers portion of Social Security taxes and self-employed individuals to defer their equivalent portions of self. How to report self-employment tax that was deferred in 2020 That section of the program is not fully functional right now but since you have until 12312022 to make the second 12. If the due date for filing a return falls on a Saturday Sunday or legal holiday then you may file the return on the next.

The portions of the employers and employee representatives shares of Tier 1 Railroad Retirement Tax Act RRTA tax under Secs. In particular the law allows self-employed individuals to defer the employer portion of Social Security payroll tax payments that would usually be due from March 27 2020 to December 31. Social Security tax deferral.

If the 15th falls on a weekend or a holiday then the. Employers who make their own payroll tax deposits will need to properly. Self-employed taxpayers who took advantage of COVID relief measures and chose to defer 50 percent of the 124 percent Social Security tax on net earnings from self-employment income.

Discover Important Information About Managing Your Taxes. Like the FICA tax half of the deferred Self-Employment Tax is due January 3 2022 and the remainder is due January 3 2023. Self-employed tax payments deferred in 2020.

WASHINGTON The Internal Revenue Service today reminded employers and self-employed individuals that chose to defer paying part of their 2020 Social Security tax obligation that a. Ad Are You Suddenly Self-Employed. 2022 4th Quarter September 1 December 31.

Self-employed can pay by EFTPS creditdebit card or check. Self-employed individuals may defer the payment of 50 percent of the Social Security tax on net earnings from self-employment income imposed under section 1401a of the Code for the. Thanks to passed legislation self-employed individuals were allowed to defer 50 of their Social Security tax portion of self-employment tax from March 27 2020 December 31 2020.

Again this must be a separate payment designated in the memo as deferred Social Security tax. Legislation allowed for self-employed individuals to defer the payment of certain social security taxes for 2020 over the next 2 years. If youre self-employed and you took advantage of the 2020 Social Security tax deferral the due date for your first payment is Dec.

3221 a and 3211 a respectively that each correspond. If using EFTPS select. The tax deferral period began on March 27 2020 and ended on December 31 2020.

If you have employees you can defer the 62 employer portion of Social Security tax for March 27 2020 through December 31 2020. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code on net earnings from self. An employer must file the required forms by the required due date.

If that first installment wasnt paid by 123121 - the entire deferral became due with penalties interest all the way back to 51521 I think that was the original due date for 2020 returns. Discover Helpful Information and Resources on Taxes From AARP. Under the CARES Act businesses employing W-2 workers were able to defer their share of Social.

2022 3rd Quarter June 1 August 31. Youd take that figure and. Because each return period is treated separately for purposes of determining the amount of tax due for the period Form 941 filers that deferred in all four quarters of 2020 may receive four.

This means that self-employed individuals that defer payment of 50 percent of Social Security tax on their net earnings from self-employment attributable to the period beginning on March. The amount of income that would qualify for the deferral period would be 57350 74000 775 or 775 percent of earnings during the deferral period.

What Does The Payroll Tax Deferral Mean For Self Employed People Legalzoom Com

Deferred Social Security Tax Payment Due Jan 3 For Self Employed Employers Local News Stories Willistonherald Com

Self Employed Social Security Tax Deferral Repayment Info

Deferred Social Security Tax Payments Due Today For Employers Self Employed Njbia

Payroll Tax Deferral Deposits Due By Jan 3 2022 Baker Tilly

Tax Deferral From 2020 Time To Pay Up Barbara Weltman

Pros Cons Of President Trump S Payroll Tax Deferral

Payroll Tax Deferral Payroll Taxes Payroll Tax Deadline

Us Deferral Of Employer Payroll Taxes Help Center

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community

What The Self Employed Tax Deferral Means Taxact Blog

Irs Releases Additional Faqs On Cares Act Deferral Of Employment Tax Deposits

Us Deferral Of Employee Fica Tax Help Center

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers

Self Employed Social Security Tax Deferral Repayment Info

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time